It requires the solving of complicated algorithms and this is a process that involves a lot of consumption of energy commodities. It also requires the use of some of the most expensive hardware known as mining hardware. Recent manufacturing cost analysis indicates that the manufacturing cost per Bitcoin is ranging from 65000 to 75000 USD. This is an indication that there is very little room from which miners are able to make profits. What price does Bitcoin need to achieve where miners can make a profit and where the network is protected is important to know especially with Bitcoin’s current value around these levels.

The sky is the limit concerning the rising cost of Bitcoin production.

Since the beginning of the use of Bitcoin, the cost of production has increased, which can be credited to the increased cost of power and complexity of equipment needed to mine the currency. Presently, the electrical cost per a single Bitcoin is merely shy of $65,000 though the cost per production in total is even higher.

If the price of Bitcoin drops below the cost of production, then miners being in the business of reselling Bitcoin begin making a loss. This can become a very huge problem because if a vast number of miners quit mining, then the security of the Bitcoin network is compromised. The desired situation for the operation of the network is the presence of enough miners to ensure security and continue its functioning.

To illustrate the profit challenge that currently confronts miners, there may be no greater and more recent example than Africa’s struggling gold producers.

Currently, Miners are earning between $2000-$5000 for a Bitcoin but some are registering losses, or just a break even. This scenario portrays the fact that for most miners, to be able to fund their operations and keep going, the price of Bitcoin needs to soar high.

Based on the information, the price has to rise at least $ 80,000 to ensure mining profits for miners exist. At this price, miners would get sufficient (between 5000 and 15000 dollars per Bitcoin) to sustain their activities without having to worry so much about income and expenditure and where they can begin new mining operations.

Why $80K is Important

These $80,000 are realistic and they are chosen purposely as the point at which the majority of miners can continue their activity unbeneficial. This price would also help to contain Electricity costs or any other costs which may be produced instantaneously.

If Bitcoin gets to $80000, there will be more miners investing in the network making it more secure for the Blockchain. This is important in maintaining confidence in Bitcoin given that it is now competing with other virtual currencies and is increasingly attracting tighter regulatory analysis across the world.

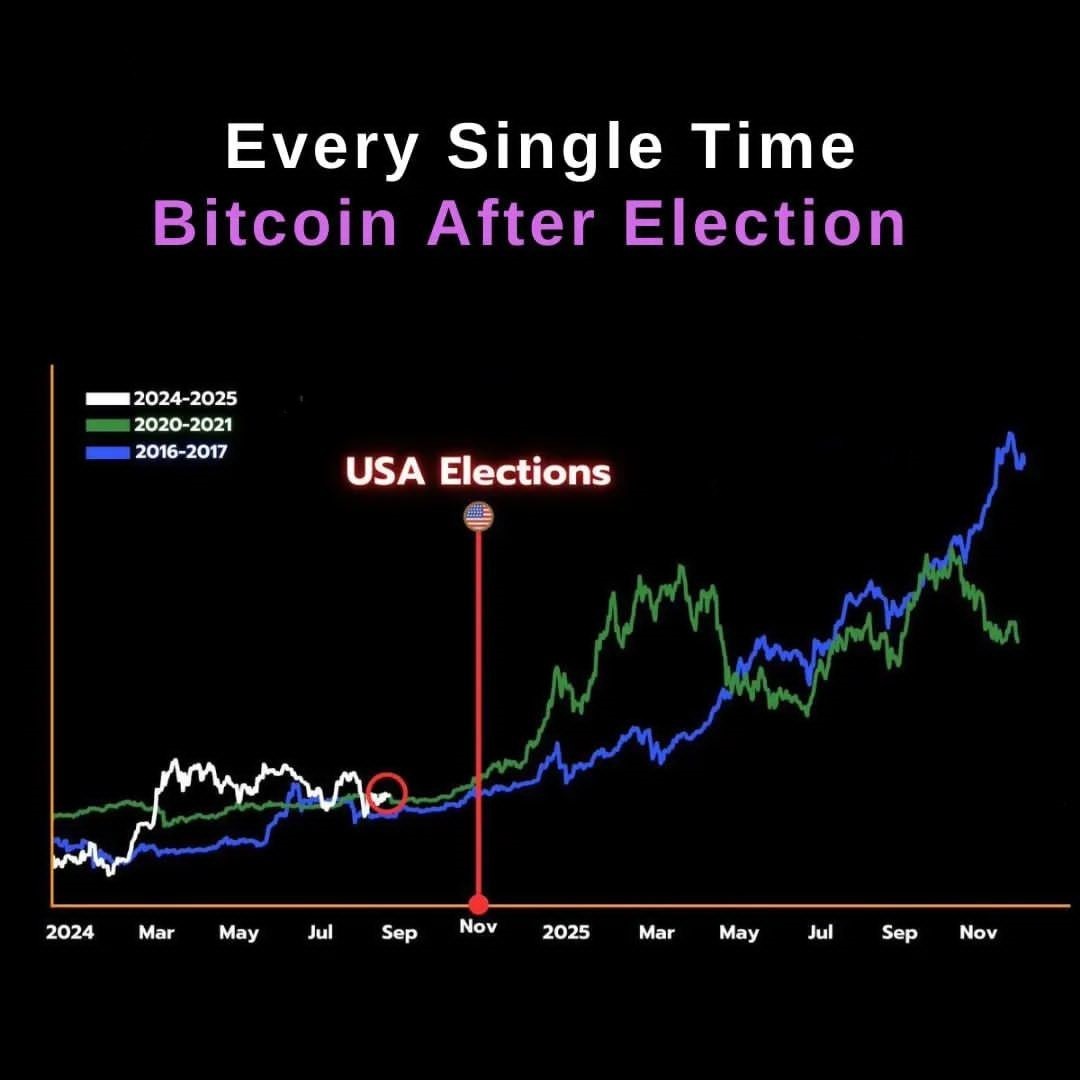

Bitcoin and U. S. Elections: What History Tells

The second thing here is to look at how the price of Bitcoin has fluctuated around the Times of elections in the U. S. Studies reveal that generally, the price of Bitcoin rises significantly after the U. S. elections. The above chart sheds the desired light by outlining the Bitcoin prices in the post-2016, -2020, and -2024 election landscape.

In all three instances, however, wider adoption was supplemented by a sharp increase in the price of Bitcoin in the successive months following the election. From this trend, it could be seen that events such as the U.S. elections can trigger an increase in the price of Bitcoin. Keeping this in mind the market has focused its attention on the consideration of whether this trend will be the same as we approach the year 2024 election.

Based on history, we could be expecting to see another massive run-up to the bitcoin price after the 2024 elections similar to how fate budding took place after the 2016 elections possibly getting closer to that $80,000 level that is very vital for miners.

Why Q4 2024 is the deciding period for the Crypto Market

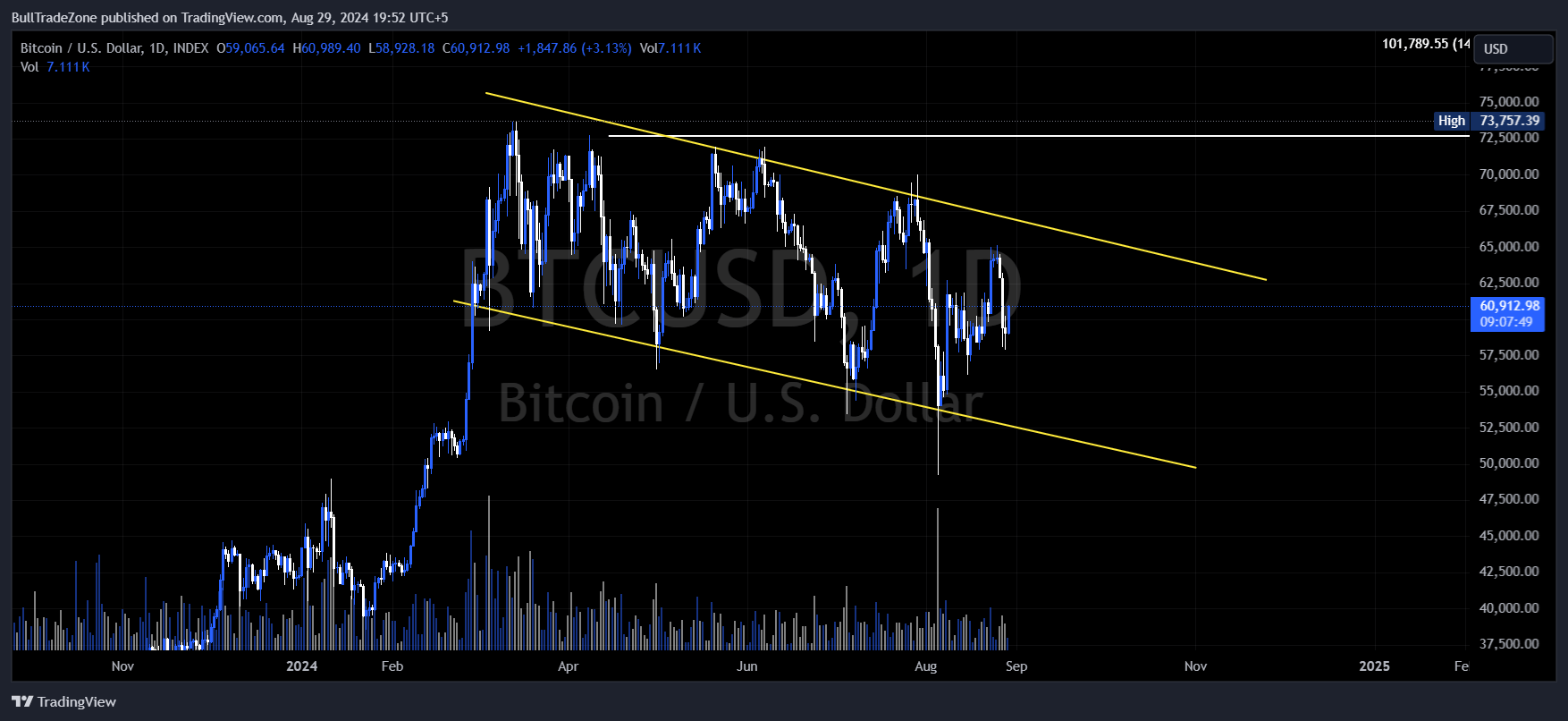

For the future, it remains to wait for the promising Q4 2024 which will be the period from October to December for the crypto cycle. According to the history of the cryptocurrency market, the last quarter of each year witnesses a high level of activity.

Several factors contribute to this:

Post-Election Policies: Given the U. S. elections, it is possible to shift to new economic policies that manner the investor behaviors and market conditions. This will result in either an increase or a reduction in the demand for Bitcoin and this may impact the value of this currency.

Institutional Investments: The fourth quarter of an economic year is when many big investors tend to lock down their investment strategies hence creating large volumes of funds that are invested in the cryptocurrency markets. This can cause the price of Bitcoin to increase more if it’s supported by market forces like the one displayed below.

End-of-Year Adjustments: People also tend to invest at the end of the year particularly in December due to changes that they make to their portfolio. This results in volatility of the prices depending on the trend of the overall market.

Historical Bull Runs: Previous cycles have depicted it that Bitcoin has a tendency to have a huge rally during Q4. This can happen again in the next year 2024, if all the aspects mentioned above come into consideration.

With all these facts in mind, Q4 2024 can become the decisive one either for Bitcoin or the entire crypto market. During these sensitive months, miners, investors, and traders must be closely watching developments that can become the key to reaching Bitcoin’s value of $80000 or even more.

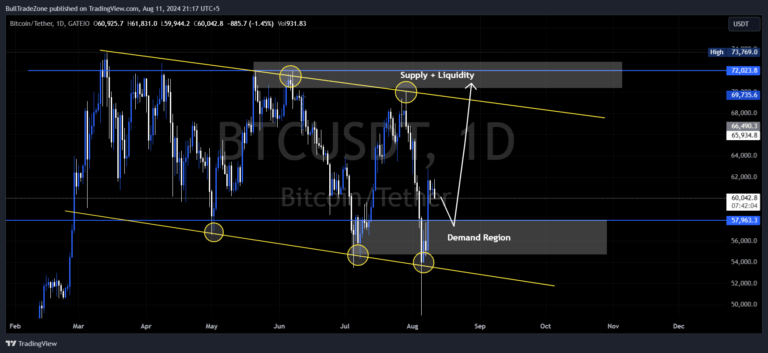

The Bull Flag Pattern and Trump’s Support for Bitcoin

Also, supporting the positive outlook for Bitcoin is the creation of the “bull flag” pattern on the BTC/USD chart in the recent past. A bull flag is that chart formation that normally suggests the continuation of an up move but with somewhat less intensity. In this pattern, it is indicated that after forming the lower trend line Bitcoin has got stuck in the middle and might be ready to move up again confirming the idea that Bitcoin has to hit higher price levels to keep the miners in business.

Furthermore, positive confirmation of Bitcoin by such personalities as the former President of the United States of America, Donald Trump could also have a positive impact. This might be due to the positive stance taken by Trump in the past when he said something positive about Bitcoin; this will see many mainstream investors and financial institutions pay more attention to the cryptocurrency, and this might push up the prices of the cryptocurrency.

A Positive Outlook

In the current climate things are not as rosy for Bitcoin, however for the medium to long term the outlook appears to be extremely favorable. This aspect could mean an upward outcome for the prices of Bitcoin since the miners seem to be recording low profitability levels. While miners are experiencing increased operational difficulties, they are forced to sell bitcoins to balance their outgoing expenses meaning that demand in the market will decrease hence the increased market prices.

The protocol of Bitcoin also has provisions for making mining easier and more profitable if a large number of miners were to exit. This resilience is one of the many that has made it possible for Bitcoin to survive and even grow despite the many bad experiences it has been subjected to in the past.

Conclusion: How to Earn $80K and More

In conclusion, due to the current situation, it is understood that Bitcoin’s price has to climb up to $80000 and higher to remain profitable for miners and guarantee the stability of the network. From the historical data, the price trends tend to go up after the election season, the critical Q4 2024 is still ahead, and the formation of the bull flag pattern makes it that the situation with Bitcoin is more or less stable despite the existing problems.

Conclusion

Moving forward it is important to keep in mind that Bitcoin works in long-term investment cycles. Although, there are lots of fluctuations in the short-term period, the long-term trend is always good for those who are willing to wait and take the risk. One day the market is going to realize that Bitcoin has potential and those who invested in it will be paid back.

Join our Free Community